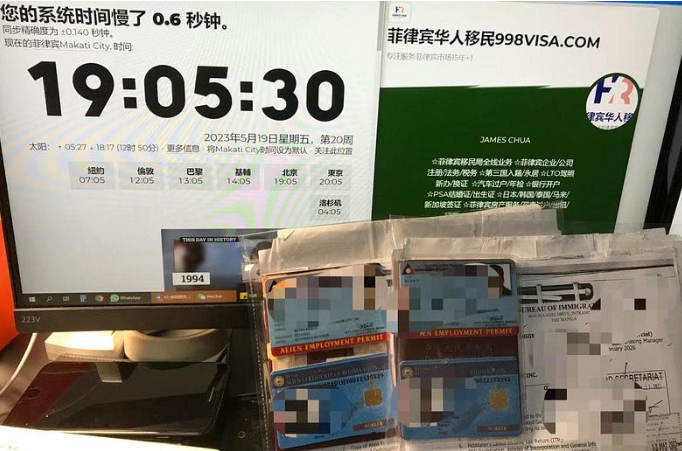

Employment Permits for Foreign Workers in the Philippines

For expatriate workers and their employers in the Philippines, it is essential they understand the process of obtaining a work visa and employment permit to legally work in the country.

We process:

Air tickets, hotels, travel /Government File processing

1. 9G Working Visa(1-3Years)

2. 13A / MCL21 TRV Spousal Visa- married to a Filipino citizen

4. Tourist Visa Extension

5. Alien Employment Permit (AEP) / Special Working Permit (SWP)

6. Inclusion of dependent Spouse and unmarried child

7. Emigration Clearance Certificate (ECC)

8. Cancellation /Apply of Alien Employment Permit replacement (loss AEP)

9. Cancellation of CEZA Working Visa (CWV)

10. Cancellation of 9G Working Visa (9G)

11.Special Resident Retiree’s Visa (SRRV) SIRV ASRV

12. Quota Visa SEC13

13. Overstay MR

14. Lifting of Blacklist(BL) and Hold Departure Order (HDO)

15. Order To Leave (OTL)

other Immigration related concern:

Alien Registration

Annual Report (A.R)

ACR I-CARD Issuance

Voluntary Application for ACR I-CARD

Renewal ACR I-CARD

Re-Issuance of ACR I-CARD

ACR I-CARD Waiver

Cancellation of ACR I-CARD

Philippine-Born Registration

Certification for Not the Same Person

ACR I-CARD Certification

BI Clearance Certification

Pending Visa Application Certification

Certified True Copy Certification

Travel Records Certification

Certificate of Non-Registration / Registration

Application for Retention / Re-acquisition of Phil. Citizenship

Inclusion of Dependents under R.A. 9225

Recognition as Filipino Citizen

Affirmation of Recognition as Filipino Citizen

Cancellation of Alien Certificate of Registry (ACR)

Special Study Permit

Provisional Work Permit

Special Work Permit – Commercial

Special Work Permit – Artists & Athletes

Joining Filipino Seaman

Signing Off Filipino Seaman

Joining Foreign Seaman

Repatriating Foreign Seaman

Filipino Supernumerary

Foreign Supernumerary

Penalty on Late Filing / Non-Filing of Foreign Seafarer’s Notice of Arrival (Joining Crew)

Administrative Fine Imposed on a Foreign Crew Member if Not Properly Documented

Penalty for Late Filing / Non-Filing of Notice of Departure

Waiver for Exclusion Ground

Downgrading of Visa

Transfer of Admission Status

Amendment / Correction of Admission

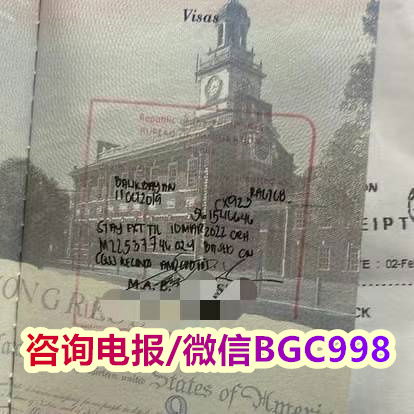

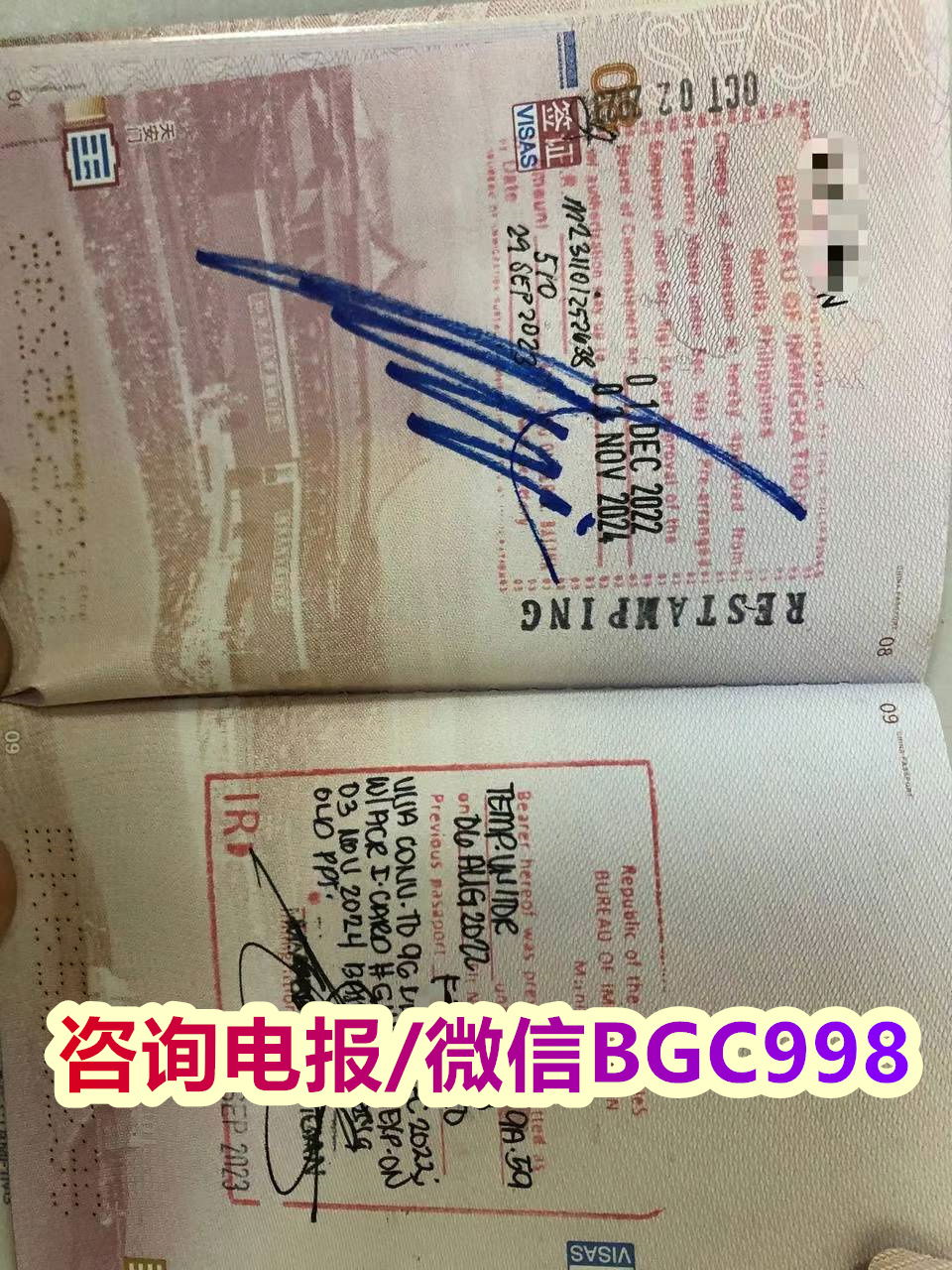

Re-Stamping of Visa RA 7919

Re-Stamping of Visa

Failed to Stamp – Encoded

Failed to Stamp – Not Encoded

Interim Extension (Grace Period)

please feel free to contact us:

English/Tagalog Inquiries :

WeChat : dpylanayon

WhatsApp :+63 939 526 6731

Telegram :@Diadem_Pearl

EMAIL: dplanayon.royalewonders@gmail.com

VIBER:+63 939 526 6731 / +63 9176523432

PHONE:

+639176523432

+639177037769

中文咨询:

微信 : BGC998 (中文)

WhatsApp :+63-912-0912-222 (中文)

电话: :+63-912-0912-222(中文)

电报/小飞机:@WOW888 (中文)

The Labor Code is the main employment statute in the Philippines and the Department of Labor and Employment (DOLE) is the administrative entity in the field of labor and employment.

Foreign nationals planning to work in the Philippines are required to secure a work visa, which can be obtained from the Philippines’ Bureau of Immigration (BI), as well as an Alien Employment Permit (AEP) issued by DOLE.

What are the employment permit and relevant visa categories in the Philippines?

Alien employment permit

An Alien Employment Permit (AEP) authorizes a foreign national to work in the Philippines. Though not a work permit, AEP is an important legal document required to secure a work visa in the country.

Some foreign nationals are exempted from obtaining an AEP. These include:

All members of the diplomatic service and foreign government officials;

Owners and representatives of foreign principals whose companies are accredited by the Philippines Overseas Employment Administration (POEA); and

Permanent resident foreign nationals and probationary or temporary resident visa holders under the Philippines’ immigration law.

Besides, foreign nationals working in the Philippines whose employers are located abroad, or those who do not have an employer are also excluded from securing an AEP.

An AEP is valid for one year, or for the complete duration of the employment contract not exceeding three years. However, the issued AEP is valid only for the position and company that it was secured for. A new AEP must be secured in the event an employee assumes a new job position within the same company or joins a new company. The application for an AEP may be filed by the employer or the foreign nationals themselves.

Requirements to apply for an AEP

Application form;

Photocopy of employee’s passport with a valid visa;

All documents related to the contract of employment;

Photocopy of current AEP (in cases of reissue); and

Photocopy of mayor’s permit or photocopy of business permit.

Pre-arranged employment visa or 9 (G) visas

The most common type of work visa issued in the Philippines is the 9 (G) visa, also known as the Pre-arranged Employment Visa. It allows employers in the country to employ foreign nationals with skills, qualifications, and experience that may be in short supply in the country. The issuance of the 9 (G) visa falls within the competencies of the BI.

A 9 (G) visa is applied through an employer’s sponsorship. Therefore, securing a job with a Philippines-based company is a prerequisite. Further, applicants are also required to obtain an AEP before securing a 9 (G)-work visa.

It is important for applicants to note that a 9 (G) holder may only work for the company that has sponsored his/her work visa. In the case of a change of employer, the 9 (G) status is downgraded to a tourist visa, and foreign workers are required to make a new work visa application.

A 9 (G) is valid for an initial period of one, two, or three years, and can be extended up to three years at a time, depending on the duration of the employment contract. The validity, however, cannot exceed the period granted under the AEP issued by the DOLE. The visa can be renewed multiple times.

Requirements to apply for a 9 (G) visa

Notarized certification of a number of foreign and Filipino employees of the employer;

Application form (Form No. 2);

A medical and physical examination report (FA Form No. 11) issued by an authorized physician;

Copy of employment contract, if any;

Four passport-sized pictures of the applicant;

Police clearance issued by the police in the applicant’s country of citizenship;

Photocopy of employment contract, Securities and Exchange Commission (SEC) certification, and Articles of Incorporation (AOI);

A certified true copy of AEP from DOLE;

BI clearance certificate;

Alien certificate of registration;

Applicant’s passport; and

Other documents are supporting the employment of the applicant.

Treaty trader’s visa or 9 (D) visa

A 9 (D) Visa or Treaty Trader’s Visa is for foreign nationals belonging to countries that have a bilateral trade agreement with the Philippines. The Philippines has such an agreement with the United States, Japan, and Germany.

Requirements to apply for a 9 (D) visa

To qualify for a 9 (D) Visa, foreign nationals must prove that:

They or their employers are engaged in substantial trade, involving an investment of at least US$120,000 between the Philippines and their country of origin;

They intend to leave the Philippines upon the completion or termination of their work contract;

They hold the same nationality as their employer or company’s major shareholder; and

They hold a position of a supervisor or executive in the company.

The Treaty Trader’s Visa is valid for up to two years.

Other nationalities who want to invest in the country can apply for special kinds of resident visas. These are:

Special resident retiree’s visa – available to international investors who are at least 35 years of age and who pay a deposit starting from US$1,500; and

A special investor’s resident visa (SIRV) – allows the holder to reside in the Philippines for an indefinite period. They must be willing to invest at least US$75,000 in the country.

Social insurance in the Philip pines

pines

The employer must make social security contributions to the Social Security System (SSS) on behalf of the employee. This monthly amount corresponds to the salaries of the covered employees.

The SSS premium for employers and employees will differ depending on the employee’s monthly compensation bracket. The SSS was scheduled to increase the premium rate by one percent for 2021 in accordance with the Social Security Act of 2018, which was signed by the President in 2019. The act allowed the pension fund to increase the premium contribution rate by one percentage point every other year starting in 2019 until it reaches 15 percent. However, the scheduled hike for 2021 was suspended by a bill passed in February 2021.

There will be a monthly charge of three percent for any overdue contributions to the SSS program. Employers contribute PHP 1,600 (US$28.38) per month for employees in the highest salary bracket. The employee themselves will contribute PHP 80 (US$1.41) to PHP 800 (US$14.20) based on their salary bracket.

In addition to the social security contributions, the employer and employee also must contribute to the Philippine Health Insurance Corporation (PHIC) and the Home Development Fund (HDMF). Foreign employees are no longer required to pay into the HDMF.

The maximum contribution by employers to the PHIC is PHP 900 (US$15.97) per month and PHP 100 (US$1.77) for the HDMF. An employee, based on their salary bracket, will pay between PHP 150 (US$2.66) to PHP 900 (US$15.97) per month for the PHIC and up to PHP 100 (US$1.77) for the HDMF.

温馨提示:本站更新内容速度比较慢 信息发布有一定时效性,所以最新资讯请联系我们获取了解,相关业务请咨询微信BGC998 电报@WOW888

更多相关阅读推荐: