PHILIPPINES Tax Consulting SERVICE

Tax Consulting

Determining current and future strategies for proactive taxation and accounting in business is important.

Determining current and future strategies for proactive taxation and accounting in business is important. Proper consultation can put in place a blue print for success; ensuring complete understanding of applicable tax code provisions and their corresponding effects.

BGC and Co. CPAs has a suite of tax consultation services that can provide your company proper aid in managing your tax and accounting departments. From investigation of certain accounting implications, to representation with the Bureau of Internal Revenue (BIR) and the Local Government Units (LGUs), to provision of updates on new tax and accounting guidelines,BGC and Co. CPAs services covers all tax-related essentials.

Our tax consultation services include:

- Tax advisory and planning

- Requisition of BIR Rulings

- Assistance in availing tax incentives

- Application of tax treaty

- Tax compliance

- Tax audit and review

- Settlement of tax returns

- Requisition of tax refund and tax credit

- Procurement of Certificate Authorizing Registration (CAR)

- Tax consultancy retainership arrangement

Tax consultation is the best way to investigate your company’s current accounting practices and implement necessary adjustments and changes. BGC and Co. CPAs team of qualified tax attorneys and accountants are equipped with proper knowledge and tools necessary to complement your needs.

Tax Incentive Programs

The Philippine government has several tax incentive programs depending on the nature of one’s business, with different incentive schemes available relative to the location and registration of the proposed business activity.

The Philippine government has several tax incentive programs depending on the nature of one’s business, with different incentive schemes available relative to the location and registration of the proposed business activity.

Although these government incentives are readily available, facilitating registration from individual offices are not always easy. There is also a large amount of post registration compliance necessary to maintain a valid tax exemption. TBGC and Co. CPAscan help your company prepare all the documentary requirements needed for acceptance, as well as monitor the compliance of the company in regard to the accepted practices of each organization.

The main fiscal benefits for investors are:

- Income Tax Holiday

- Reduction of the Rates of duty on capital equipment, spare-parts and accessories

- Exemption from wharf dues and export tax, duty, impost and fees

- Exemption from taxes and duties on imported spare parts

- Additional Deductions from Taxable Income

- VAT zero-rating

The main non-fiscal benefits for investors are:

- Employment Of Foreign Nationals, allowing them to qualify for a special visa.

- Simplification of customs procedures for the importation

- Importation of consigned equipment

- The privilege to operate a bonded manufacturing/ trading warehouse subject to customs rules and regulations

Philippine tax incentive programs under:

- Board of Investments (BOI)

- Regional Board of Investments in Autonomous Region in Muslim Mindanao (RBOI-ARMM)

- Regional Headquarters/Regional Operating Headquarters (RHQ/ROHQ)

Philippine tax incentive zones:

- Philippine Economic Zone Authority (PEZA)

- Subic Bay Metropolitan Authority & Clark Development Corporation (SBMA & CDC)

- Cagayan Economic Zone Authority (CEZA)

- Zamboanga Economic Zone Authority (ZEZA)

- PHIVIDEC Industrial Authority (PIA)

- Aurora Special Economic Zone Authority (ASEZA)

BGC and Co. CPAs registers companies to any of the government’s incentive programs quickly and effectively by applying our ISO certified operating principles, greatly reducing possible delays. With our expertise, we can help your company operate in the Philippines with the best incentives the country can offer.

BGC and Co. CPAs is a mid-sized progressive auditing firm providing comprehensive set of cost effective solutions to organizations like yours.

Our services include auditing, accounting, bookkeeping, business management, and HR consulting. Further, we provide other business services like VISA processing in Bureau of Immigration (BI), Philippine Retirement Authority (PRA).

We are equipped with state of art tools and techniques along with dedicated professional to evaluate potential opportunities and risks effective auditing and assurance services. We understand a value adding auditing and assurance service focus on scope of business improvement rather than merely preparing financial statements and reporting on figures.

The firm was formed to assist clients on the preparation of compliances relating to tax, financial management, forecasting and accounting software and system installation. Assist clients in tax investigations, internal auditing procedures and provide on financial, taxation, accounting and auditing matters when needed. Processing of business registration, cancellation / termination.

Our Mission

Deliver reliable cost effective professional services in time meeting specific customer requirements.

Our Vision

To become one of the best auditing and accounting firm in the Philippines providing the utmost satisfaction to all the clients. We would like to be known as one of the finest company to partnered with in all the aspects.

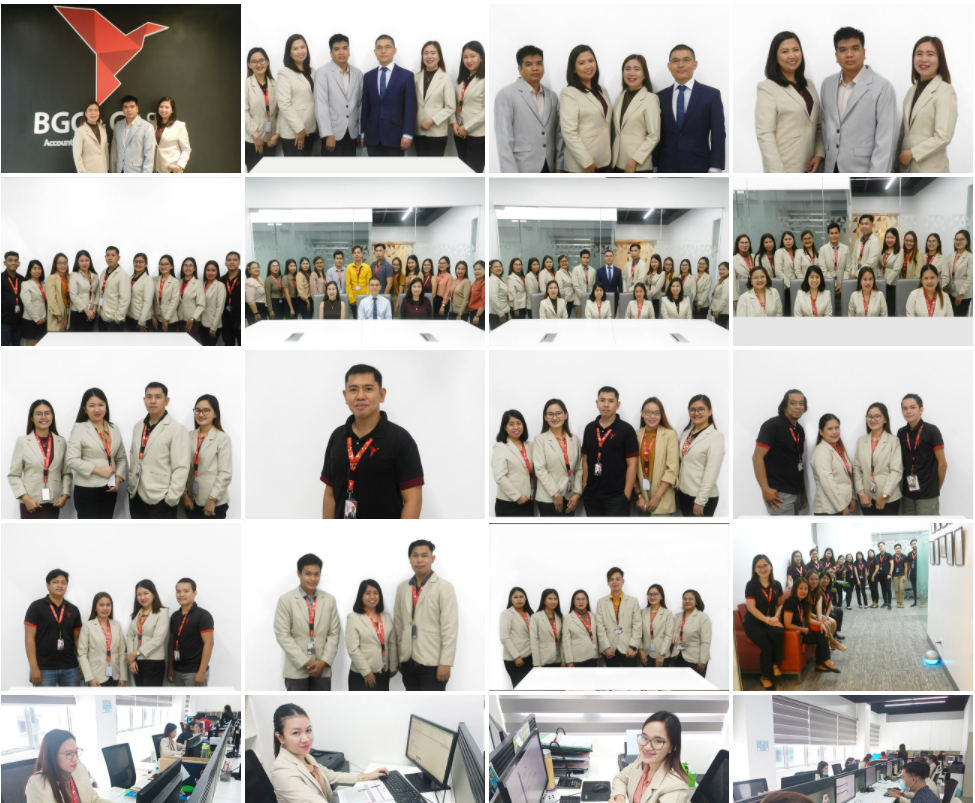

Our Team

Our teams of dedicated professionals led by senior qualified accountants are obliged to give you quality services which will enable you to serve your clients better and there by improve your business. We together with our associates enable to give you the best in the industry.

ABOUT OUR SERVICES

Auditing and Assurance

We are equipped with state of art tools and techniques along with dedicated professional to evaluate potential opportunities and risks delivering effective auditing & assurance services. We understand value adding auditing and assurance service focus on scope of business improvement rather than merely preparing financial statements and reporting on figures.

Our expertise in analyzing accounting systems, designing better systems with proper internal controls and management information reporting help our clients to adequately plan their business building strategy and give them the confidence to pace up with the rapidly growing economy.

Accounting and Bookkeeping

Accounting and bookkeeping is a necessity of every organization irrespective of its size. Our professionally qualified and experienced accountants understand and analyze business transactions and ensure compliance with the accounting standards. BGC has well trained staff familiar with many of the accounting system and most especially to the rapid changes in the BIR rules and regulations. Qualitative and timely accounting reports are crucial for the success of any business organization. BGC ensures relevant and reliable financial reports are delivered on regular intervals to assess performance and to facilitate decision making. Outsourcing of accounts department helps you to get professional expertise at lower cost and BGC provides the most efficient and effective bookkeeping solutions.

We assist you with below services:

• Accounts preparation and supervision

• Preparation and presentation of financial reports

• Bookkeeping services

• Payroll processing

• Training of accounting staff

Business Set-up and Termination

We do assist in setting up different types of business organizations through registrations to different government agencies such as:

• Securities and Exchange Commission (SEC);

• Bureau of Internal Revenue (BIR);

• Local Government Unit (LGU);

• Department of Trade and Industry (DTI);

• Social Security System (SSS);

• Philippine Health Insurance (Philhealth);

• Pag ibig;

• Food and Drug Administration (FDA)

We also assist our foreigner clients for the following:

• VISA extension;

• Bureau of Internal Revenue (BIR);

• 9g VISA;

• Special Resident Retiree’s VISA (SRRV)

• Social Security System (SSS);

• Passport Renewal

We process:

Air tickets, hotels, travel /Government File processing

1. 9G Working Visa(1-3Years)

2. 13A / MCL21 TRV Spousal Visa- married to a Filipino citizen

4. Tourist Visa Extension

5. Alien Employment Permit (AEP) / Special Working Permit (SWP)

6. Inclusion of dependent Spouse and unmarried child

7. Emigration Clearance Certificate (ECC)

8. Cancellation /Apply of Alien Employment Permit replacement (loss AEP)

9. Cancellation of CEZA Working Visa (CWV)

10. Cancellation of 9G Working Visa (9G)

11.Special Resident Retiree’s Visa (SRRV) SIRV ASRV

12. Quota Visa SEC13

13. Overstay MR

14. Lifting of Blacklist(BL) and Hold Departure Order (HDO)

15. Order To Leave (OTL)

other Immigration related concern:

Alien Registration

Annual Report (A.R)

ACR I-CARD Issuance

Voluntary Application for ACR I-CARD

Renewal ACR I-CARD

Re-Issuance of ACR I-CARD

ACR I-CARD Waiver

Cancellation of ACR I-CARD

Philippine-Born Registration

Certification for Not the Same Person

ACR I-CARD Certification

BI Clearance Certification

Pending Visa Application Certification

Certified True Copy Certification

Travel Records Certification

Certificate of Non-Registration / Registration

Application for Retention / Re-acquisition of Phil. Citizenship

Inclusion of Dependents under R.A. 9225

Recognition as Filipino Citizen

Affirmation of Recognition as Filipino Citizen

Cancellation of Alien Certificate of Registry (ACR)

Special Study Permit

Provisional Work Permit

Special Work Permit – Commercial

Special Work Permit – Artists & Athletes

Joining Filipino Seaman

Signing Off Filipino Seaman

Joining Foreign Seaman

Repatriating Foreign Seaman

Filipino Supernumerary

Foreign Supernumerary

Penalty on Late Filing / Non-Filing of Foreign Seafarer’s Notice of Arrival (Joining Crew)

Administrative Fine Imposed on a Foreign Crew Member if Not Properly Documented

Penalty for Late Filing / Non-Filing of Notice of Departure

Waiver for Exclusion Ground

Downgrading of Visa

Transfer of Admission Status

Amendment / Correction of Admission

Re-Stamping of Visa RA 7919

Re-Stamping of Visa

Failed to Stamp – Encoded

Failed to Stamp – Not Encoded

Interim Extension (Grace Period)

please feel free to contact us:

English/Tagalog Inquiries :

WeChat : dpylanayon

WhatsApp :+63 939 526 6731

Telegram :@Diadem_Pearl

EMAIL: dplanayon.royalewonders@gmail.com

VIBER:+63 939 526 6731 / +63 9176523432

PHONE:

+639176523432

+639177037769

中文咨询:

微信 : BGC998 (中文)

WhatsApp :+63-912-0912-222 (中文)

电话: :+63-912-0912-222(中文)

电报/小飞机:@WOW888 (中文)

AUTHORIZED INSTITUTION

想了解更多欢迎联系和咨询我们,中文 微信BGC998 电报@BGC998